This post may contain affiliate links. Please read our disclosure policy.

There is a quote by Nelson Mandela that I love – “It is always impossible until it’s done”. I tend to live my life a bit this way. I wouldn’t call myself the greatest trailblazer nor am I a big risk-taker. But, I have a tendency to never take ‘No’ for an answer and my husband is certainly the same way. When it came to buying a new house, we were no different.

**None of this information is sponsored nor are there any affiliate links. Any recommendations I’ve provided in this article is purely for your benefit.

1) Haters Gon’ Hate!

We started our search in December 2018 and really didn’t know what we were looking for. We were open to many areas of Atlanta, many styles of homes, etc. For months and months my husband would tell me that we needed to look for a “fixer-upper” and finance the renovation. We ran that idea by our real estate agent and loan officer and they both gave us a resounding NO – BAD IDEA!

With each turnkey home we would visit we kept coming back to the idea – what about a fixer upper? We loved the concept of putting our stamp on a home and creating our own unique floorplan. But again, were basically told in a nice way that it was not for people like us. They said, you need a lot of money, there is tons of paperwork, the closing time is too long, no seller will accept your offer, etc.

I moved on from the idea but my husband couldn’t let it go. Something inside him knew this was our path, but I began to shut down the idea. I’d say to him “Come on, we asked the professionals, they all told us it’s way over our heads for first time home buyers. Let’s just try to find a move-in ready house that we can be happy enough with and we can rehab our second home.” He still couldn’t let it go. So I got back to researching and asked questions in the forums on Bigger Pockets. We started to find a network of people that supported our decision. We slowly realized it was really just more convenient for our real estate agent and loan officer if we’d just hurry up and make a damn decision on a house so they could get paid. They were the ones that didn’t want to be troubled with the extra effort and time it may take for us to do a rehab loan.

Needless to say, we moved on to find a real estate agent that understood our needs and was excited to help us find exactly what we wanted. We were also referred to a different mortgage company that specializes in renovation loans. We felt a bit like aliens that just found their home planet LOL. We were suddenly surrounded by people that fully supported and educated us on this process of doing a renovation loan. Which brings me to my next point….

2) Surround Yourself With The Right Professionals

It’s extremely important to remember that if you are interested in taking on this adventure, not many people will understand your decision. That’s OK, but don’t allow it to discourage your life choices. It’s OK to be different, even if it means you are taking a more challenging path to reach the results you are seeking.

My referral to my real estate agent won’t help many as he’s local in Atlanta, but for those of you that may be reading this and need a really solid agent that has your true best interest at heart, Scott West with MetroBrokers is the man!

For a renovation loan, Homebridge Financial actually specializes in renovation loans. They don’t really advertise this much but they are (I believe but don’t quote me) the #1 provider of renovation loans in the country. Once we got passed the due diligence period, this loan process was relatively painless, of course the nature of this type of loan does add a bit more work and money on the front end of the process, but the actual loan officers and underwriters were a breeze to deal with.

You will also need homeowners insurance and good luck getting a reasonable quote from any insurance company other than Allstate. We were getting quotes in the $2,500 – $4,000 range for annual homeowners insurance with Progressive, Liberty Mutual, Nationwide, Geico, etc. I am not sure why you are punished by most insurance companies for doing a renovation on your home. We had been longstanding customers of Progressive and actually ended up leaving them just so we could bundle with Allstate instead. Our homeowners policy ended up being $130 per month (~$1,500 annually).

Finding the right contractor: now this is an extremely difficult area. There is a lot of ego, shadiness and just downright unprofessionalism in the General Contracting world. You have a very limited amount of time to find the contractor you will be hiring, so I strongly recommend that before you even put in an offer, you begin to scope out contractors. Once your due diligence period begins you are already a little too late. You don’t want to find the best in town because they will charge you literally twice what the job could be completed for. You also don’t want to find the cheapest either. Begin to research and meet with contractors as early as possible and be sure to listen to your instinct!

3) Have Faith & Patience

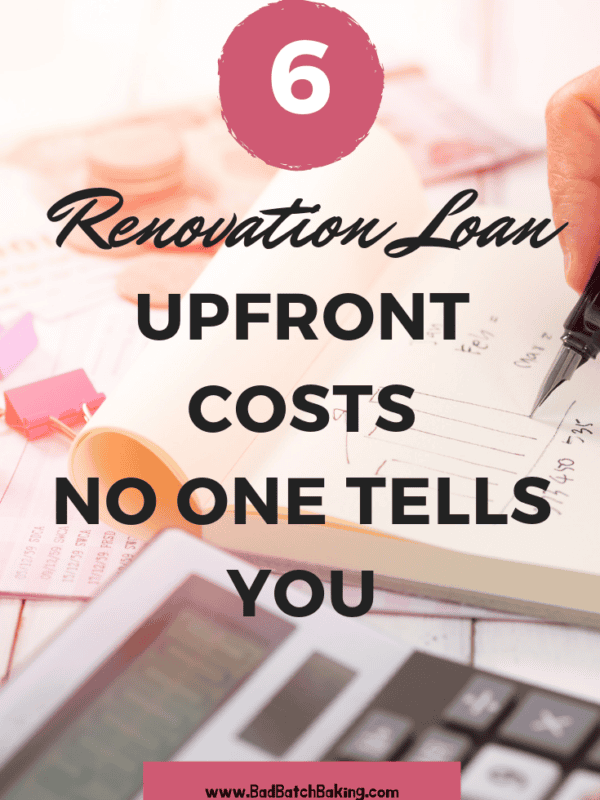

There are many aspects of this process that will truly test your patience and sanity. You can read more about the upfront costs and headaches here in this post. There is a lot of craziness with this loan but a lot of that goes with buying a home in general. And again, if it means really getting what you want – isn’t that worth every ounce of stress?

There will be a new problem each week. It may distract you from doing your job at work, you’ll be constantly taking phone calls to talk to your contractor, etc. But remember that every day is a new day and each problem WILL end up getting resolved. Soon enough you’ll be so distracted with new issues you won’t even remember what troubled you last week. It’s just one big puzzle that you are constantly trying to put together.

The one thing that kept us motivated and grounded through this process was remembering all of the people that told us we weren’t cut out for doing a renovation. I seriously refuse to prove any of them right. Yes, it is crazy, I may have a few gray hairs from this whole thing, but I will never agree with it being unattainable for someone “like me”.

My mom always reminds me of the best saying. THIS TOO SHALL PASS. It always does and it always will.

I’ll leave you with this photo I took of my husband staring in awe at the home we had just put an offer on. Very proud day for both of us!

If you have any questions or comments, feel free to leave them down below!

Thank you for sharing your experience and journey of buying a fixer-upper house. Your determination to follow your dreams and not let the opinions of others discourage you is truly inspiring.

It’s great that you found a real estate agent and loan officer who supported your decision and helped you find the right mortgage company for a renovation loan. Surrounding yourself with the right professionals is key to success in any endeavor, and you’ve emphasized that point beautifully.

I also appreciate your honesty about the difficulties of finding a good contractor and dealing with the many challenges of the renovation process. Your advice to research and meet with contractors early on and to trust your instincts is invaluable.